Date: 2017-04-21 Source: 本站

Objectives and Principles

The Financial Blockchain Shenzhen Consortium (hereinafter referred to as “FISCO”, or “the Consortium”) was established in the backdrop of a surge in domestic and foreign financial giants tapping into the blockchain technology. The boom is driven by the development of digital economy and the demand for free flows of digital assets, as well as the gradual establishment of a new type of cross-industry and -regional trust mechanism. FISCO advocates the construction of financial distributed ledger based on blockchain technology. By promoting the technology based on business requirements, the Consortium will explore and apply the application architecture and principles of “consortium blockchain” for the financial industry. It will also study how to improve the blockchain technology in order to meet financial firms’ needs, as well as to promote the real-world applications.

The following basic principles are proposed to speed up the application of financial distributed ledger based on consortium blockchain technology:

1) Legal Compliance: During the construction of the distributed ledger, all FISCO members should comply with relevant laws and financial regulations, and provide technical support for regulatory and auditing requirements;

2) Traceability: Full records need to be logged for all business activities on the distributed ledger to meet tracking and auditing requirements;

3) Security: The distributed ledger and related business applications should adopt all necessary measures to ensure the security of assets and transaction data on the chain, as well as to prevent external and internal cyber attacks;

4) Privacy Protection: Distributed ledger-based business applications should adopt encryption, digital signature, access control, and other security measures to protect user privacy on the chain, and prevent personal data leaks;

5) Business Driven: When developing distributed ledger-based applications, business requirement should remain the top priority to ensure reliability, efficiency and stability, with technology development driven by actual business needs.

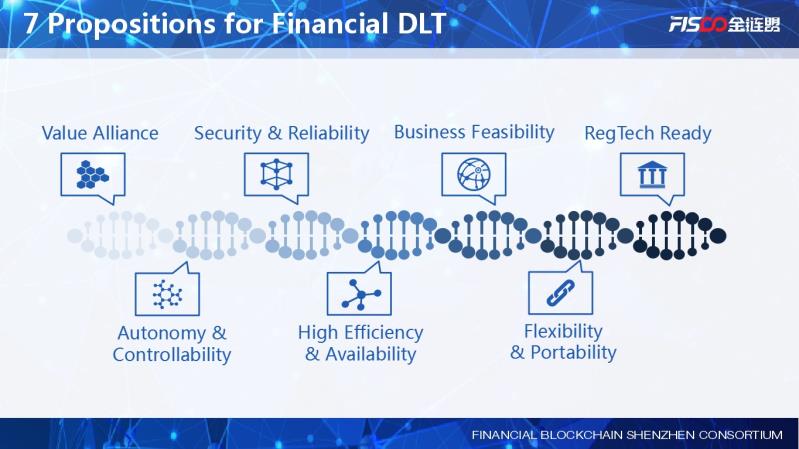

FISCO’s Seven Propositions for

Financial Distributed Ledger

The main objective of FISCO is to explore the blockchain technology applications for the financial sector. In order to establish the ecosystem of the financial distributed ledger, members should be guided by national laws and regulations, build upon the existing financial business and IT infrastructure, and oriented by the “finance + blockchain” concept. FISCO should also promote the development and innovation of the financial industry via blockchain technology, and propel the transformation from information-based Internet into value-based Internet.

The following seven propositions are proposed for financial distributed ledger based on above objectives and principles:

Proposition I: Value Alliance

The distributed ledger records exchange and registration information of specific values, based on which a value alliance is formed by multiple business parties. The establishment of each distributed ledger will facilitate the business development of a specific value alliance. Different industry specifics, business models, and common value objectives will differentiate the various alliances’ distributed ledgers. A specific type of business will have a specific distributed ledger. In the financial industry, different distributed ledgers will be used to manage different types of financial assets and business models to meet business targets of the alliance.

Proposition II: Autonomy and Controllability

The existing foreign blockchain and distributed ledger technologies may not fit China’s unique financial environment due to compliance, security and stability requirements of financial institutions. It is also difficult to apply the existing imported technologies to large-scale commercial activities. Therefore FISCO advocates the principle of autonomy and controllability to guide the construction of financial distributed ledger and the gradual establishment of the autonomous ecosystem. Autonomy and controllability can be ultimately achieved for the overall consortium blockchain framework, distributed ledger network, key infrastructure, application systems, encryption algorithms, core codes, and other components. FISCO encourages financial institutions to review their existing business models and processes to innovate and enhance their businesses based on the proposed distributed ledger technology infrastructure.

Proposition III: Security and Reliability

The financial industry has stringent requirements for licenses approval, privacy protection, network security, fund security, anti-money laundering and anti-fraud protection, etc. To ensure the security and reliability of business activities, financial distributed ledger should be highly reinforced in the following areas:

1. Distributed ledger infrastructure should leverage existing security systems, and to integrate with the encryption and digital signature measures of the blockchain technology to ensure transaction security, data integrity and non-repudiation;

2. Perform authentication for institutions and inpiduals that have access to the financial distributed ledger according to financial KYC requirements, and implement access control to meet anti-money laundering and anti-fraud requirements.

3. Strictly implement customer privacy protection based on the principal of "minimal data requirement,” i.e. to minimize date transfer and usage to meet business needs. To prevent customer data leaks by implementing access control, data isolation and encryption measures.

4. Establish ownership relations between users and assets on the blockchain to ensure security of financial assets, for instance, by defining measures like loss report, account freeze and transfer of ownership, potential asset loss can be prevented if loss of user credentials or account information leak ever occurs.

Proposition IV: High Efficiency and Availability

High performance, flexibility and availability can be achieved by taking the following measures combined with features unique of blockchain technology:

1. The financial distributed ledger built on the top of consortium blockchain technology can highly improve efficiency of consensus algorithms. It shortens the time of reaching a consensus compared with public blockchain. It also improves transactional performance by eliminating consensus algorithms which consumes substantial computational resources, like Proof of Work (POW) algorithm.

2.Deploy blockchain nodes on a flexible and extensible distributed architecture to enable efficient scale-up of the financial distributed ledger and to achieve fast upgrade of overall capacity and unit processing performance.

3. Construct the consortium blockchain in accordance with the regulatory requirement of “multiple data centers within one city plus remote backup in a different city for disaster recovery.” High availability considerations including network communication links and redundant backups for system and data should be made to ensure the reliability and availability of the system deployed. Meanwhile, the heterogeneity nature and highly redundant deployment architecture based on the Consortium’s P2P protocols ensures high availability of the distributed ledger. If software problems occur at a node, service of the consortium chain’s network will not be affected in general.

Proposition V: Business Feasibility

Blockchain technology has the advantages of distributed features, traceability, non-repudiation, enhanced trust mechanism, collective maintenance and reliable data storage, etc. Financial institutions can apply blockchain technology to resolve business problems at hand, and regard the distributed ledger as a technical component to improve existing business procedures. Blockchain applications in more business scenarios will help to further advance the technology and improve its support to the financial industry in return, for example, to boost efficiency and cut cost of funding for clearing and settlements among financial institutions via distributed and tamper-resistant ledgers.

Proposition VI: Flexibility and Portability

Due to members' different choice of technologies and development models, a unified technology platform and standardized technical components are needed to remove technical barriers, reduce costs, enhance members’ R&D capability of blockchain technology, speed up the construction of enterprise application software, and promote the development of blockchain technology in the financial industry. The goals can be achieved by standardizing development language, enacting a unified interface protocol and customizing standard APIs and component templates. In addition, a modularized, componentized platform can also be realized. For example, by defining a common programming language for smart contracts can facilitate rapid business application development; to standardize interface protocols and APIs can make an inventory of plug-in-ready components; to develop common financial business services or infrastructure modules will facilitate quick time-to-market.

Proposition VII: RegTech Ready

According to relevant laws, regulations, industry policies, business standards and technical requirements, the governance and regulation of financial distributed ledger comprise two parts in general: the first part involves fully automated governance rules within the technical systems consist of software, protocols, algorithms, smart contracts and support facilities, and other technical components; the second part contains governance rules that can’t be automated and require oversight from regulatory personnel. FISCO advocates a balance between the two aspects to ensure regulatory compliance of all activities on the consortium blockchain. It also encourages the use of technologies such as smart contracts to support auditing and regulatory activities. Overall, FISCO proposes the use of access pre-approval, in-process authorization management, global transaction control, auditing and other measures to ensure data integrity, traceability and auditability, in order to meet requirements of various regulatory bodies.

Summary and Outlook

FISCO as being a pioneer of blockchain technology in the financial sector will adhere to the five principles and seven propositions of financial distributed ledger as stated above. As technology advancement should be driven by real business needs, the Consortium will explore more business scenarios through iterative development of financial distributed ledger in an approach taking consideration of both ideology and pragmatism. To achieve sustainable technology innovation in the financial sector, FISCO will thrive to encourage the above principles and propositions in real-life practices.